P/E

Price-to-Earnings Ratio

Example

Our P/E was down from last year but we hope to bounce back in the next four quarters

Related Slang

| EBT | Earnings before taxes |

| ISO | Incentive stock option |

| NSO | Non-qualified stock option |

| NQSO | Non-qualified stock option |

| CEO | Chief executive officer |

| CFO | Chief financial officer |

| EPS | Earnings per share |

| NYSE | New York Stock Exchange |

| FAANG | Facebook, Amazon, Apple, Netflix, Google |

How well do you know your texting slang?

How well do you know your texting slang?

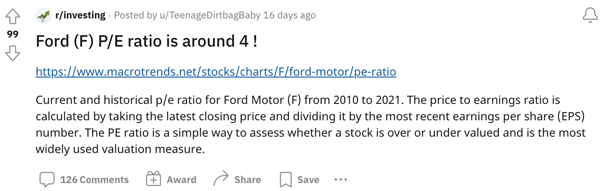

Investors use a company's P/E, or Price-to-Earnings Ratio, to determine whether the company is valued correctly. A high P/E might mean a stock is overvalued, while a low P/E might mean a stock is undervalued.

P/E is calculated by dividing a company's current stock price by its EPS (earnings per share). Usually, the EPS used is an average from the last four quarters, and the calculated P/E is referred to as a trailing P/E. However, P/E can also be calculated using projected EPSes, in which case it is referred to as a forward P/E.