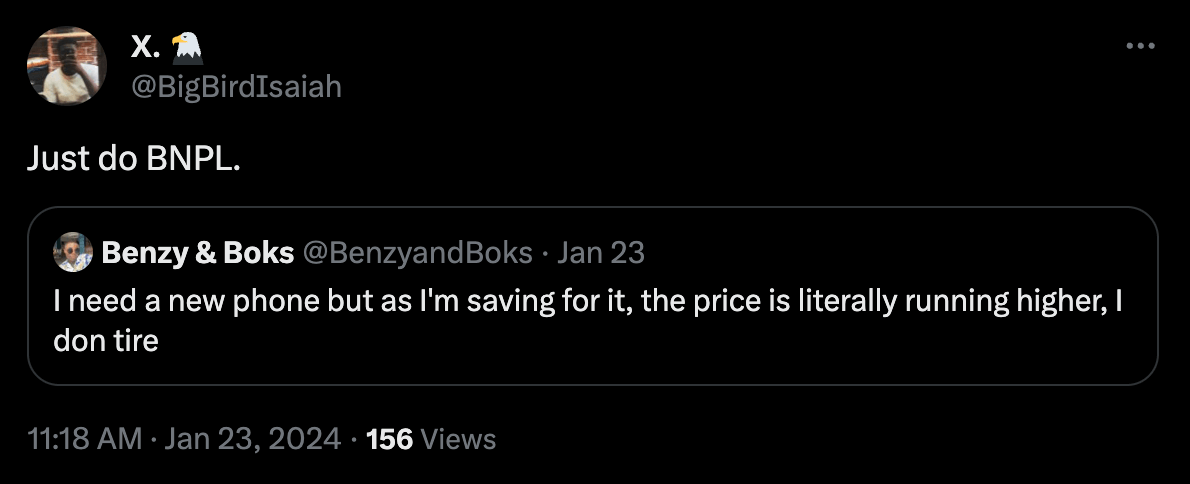

BNPL

Buy now pay later

Example

i think bnpl options are convenient but i just wouldn't be able to keep track of them all if I paid that way

agreed. if i can't afford it now, i don't buy it. otherwise my shoe collection would get wayyy out of hand

Related Slang

| CC | Credit card |

| EMV | Europay, MasterCard, and Visa |

| CIP | Customer initiated payment |

| EFT | Electronic funds transfer |

| ATS | Automatic transfer service |

| Shut up and take my money | I want to purchase that |

| IAP | In-app purchase |

| Freemium | Free with optional purchases |

| MRR | Monthly recurring revenue |

| AR | Accounts receivable |

How well do you know your Fantasy Football slang?

How well do you know your Fantasy Football slang?

BNPL is a payment option where a customer can immediately buy an item, service, etc., but pay for it later (often over multiple installments). For example, a consumer might want to buy a piece of jewelry now for $550 but does not have the total amount required. In this case, BNPL allows the consumer to purchase the jewelry and obtain it now (they may be required to make a small down payment, say $50), then pay for the rest later (possibly a payment of $100 a month for the next five months).

While variations of BNPL have existed for centuries, the payment option became popular in the late 2010s as e-commerce and mobile purchases became prevalent. Now, many merchants provide a BNPL choice at the point of sale for their goods or services (often less than $1,000), including apparel, appliance repair, travel, jewelry, and even gasoline and groceries.

How BNPL works

When you choose the BNPL option, the financier supporting the payment option performs a quick soft background check of the consumer and then approves or rejects the attempt. If the purchase is accepted, the financier pays the merchant in full and receives payment from the consumer over the following weeks or months (sometimes years).

The consumer may be required to pay a small down payment (e.g., 20% of the purchase amount) at the point of sale. And then, they re-pay the rest in the following weeks, months, etc. (typically free of interest).

BNPL positives and negatives

The BNPL financing option is beneficial for businesses to reach consumers who want to obtain their goods or services but can't pay for them in full at the current moment. BNPL is also convenient for consumers since it allows them to make purchases quickly, and it is easier for them to get approved by BNPL financiers than by most credit card providers. However, since BNPL is so convenient, it may also produce more impulse purchases that lead to overwhelming debt if consumers don't accurately track their purchases.