HFT

High-frequency trader

Example

They should crack down on HFTs. I think all of that stuff should be illegal

Agreed

Related Slang

| NYSE | New York Stock Exchange |

| Big Board | New York Stock Exchange |

| Bagholder | A person who fails to sell a stock before it crashes |

| Paper hands | To sell a stock at the first sign of trouble |

| Diamond hands | To hold a stock through losses |

| Meme stock | A stock hyped on social media |

| Dough | Money |

| Moolah | Money |

| Hax | Hacks |

| Haxor | Hacker |

| AI | Artificial intelligence |

Can you score under par in this golf terms quiz?

Can you score under par in this golf terms quiz?

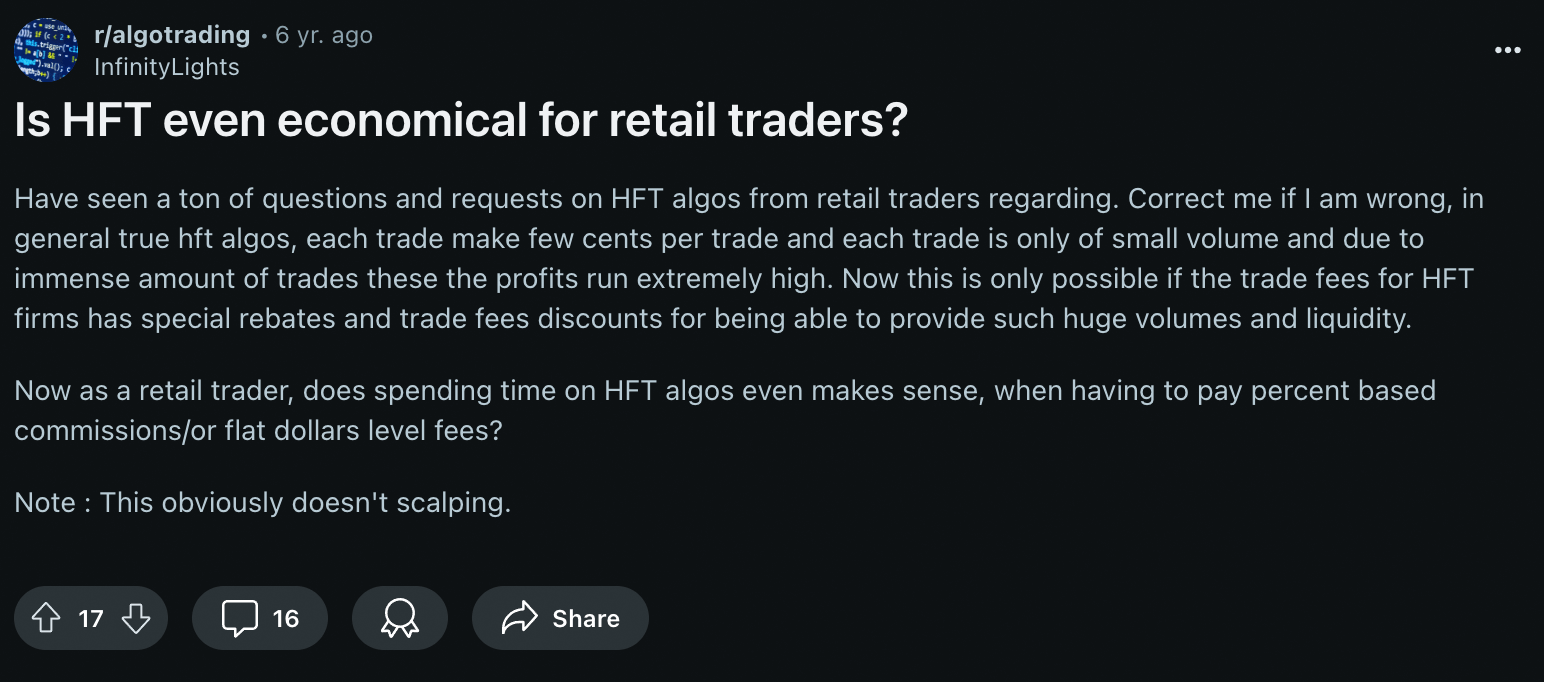

HFT is shorthand for a stock market trader who uses advanced computers and algorithms to make rapid trades, often in fractions of a second. The HFT strategy revolves around the idea that if you take advantage of any price changes (usually minimal), the tiny but numerous gains will accumulate into a substantial, worthwhile amount.

HFTs have grown since the early 1980s when the stock market went fully electronic. Now they are a significant aspect of today’s stock markets, with their rapid trading affecting prices and liquidity.

While HFTs aim to make fast money, their activity makes the market more volatile. Investors often view high-frequency traders negatively because those with the fastest technology have an unfair advantage.