BTD

Buy the dip

Example

Related Slang

| Buy the dip | Buy an asset at a low price |

| BTFD | Buy the freaking dip |

| NYSE | New York Stock Exchange |

| HFT | High-frequency trader |

| Meme stock | A stock hyped on social media |

| Stonks | Questionable or meaningless financial gains |

| USD | United States dollars |

| Retail investor | Individual, non-professional investor |

| Bullish | Positive outlook |

| Diamond hands | To hold a stock through losses |

Categories

Bloons Tower Defense

BTD, or Bloons TD, is a gaming series where players attempt to pop balloons (bloons) before they reach the end of the course. Ninja Kiwi develops the game, which is available for various platforms, including iOS, Android, and Nintendo DSi.

The game premiered in 2007 and includes several entries and spin-offs, such as Bloons TD Battles and Bloons Monkey City. While the BTD series has been around for years, it is still not well-known, so mostly only BTD gamers will use the acronym to refer to the game.

Example

Related Slang

| MOAB | Massive Ornary Air Blimp |

| Gamer | A video game player |

| Grinding | Performing repetitive tasks to level up |

| HP | Hit points |

| arpen | Armor penetration |

| GG | Good game |

Categories

Bored to death

BTD is an acronym that means "bored to death." Overly dramatic chatters and texters use BTD to express just how dreadfully, utterly bored they are.

If someone tells you they are BTD over and over again, you may want to encourage them to shake things up a bit. Otherwise, you may end up becoming brd of them ...

Example

A BTD Bart Simpson

Take the pop culture acronym challenge

Take the pop culture acronym challenge

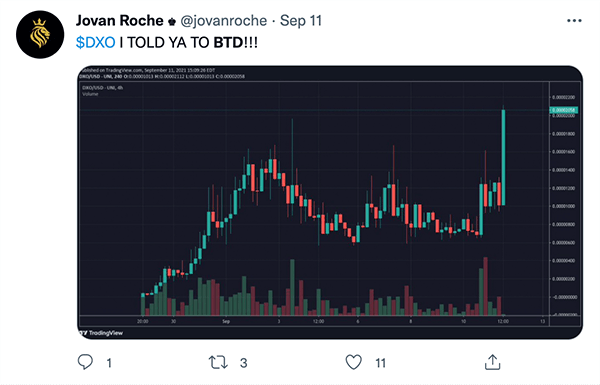

BTD stands for "buy the dip," a financial strategy that includes purchasing an asset when it dips in value to get a good deal when it hopefully rebounds. You will most likely see it online in articles, forum discussions, and social media posts about finances.

You can apply the BTD strategy to any item where its value fluctuates. However, it mainly pertains to the stock market and cryptocurrencies.

BTD, or BTFD (the more enthusiastic variation), is a mantra for many financial traders that reflects how they invest. The strategy can be incredibly lucrative as long as you time the market well and predict the direction of a financial asset.

However, there are risks with BTD. The main one being, if you are wrong about the direction of the asset, you could lose a lot of money.